At least five years time horizon.

B&H Jubilación

Management 0,90%

Success 6% of profit

Depository 0,05%

PORTFOLIO DETAIL

PROFITABILITY

Documentation

Awards

For investors with at least five years time horizon.

Our pension plan to prepare your retirement.

B&H Jubilación selects both bonds and stocks, with the objective of optimizing long-term returns. The plan may have a maximum equity exposure of up to 75%.

The portfolio is comprised of our highest conviction ideas in both bonds and equities.

In bonds we seek an optimal balance between their returns and risks, while achieving an adequate correlation and diversification with our equity portfolio.

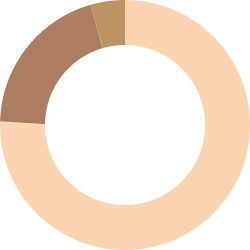

Portfolio composition for B&H Jubilación

72% Equity

24% Bonds

4% Liquidity

Our pension plan builds the financial well-being for your retirement by combining our highest-potential and most reliable investments in bonds and stocks, measuring their weights based on market opportunities.

We prefer quality, easily understandable businesses at reasonable prices.

We like companies that combine low debt levels with long-term earnings-per-share growths.

Returns from launch

B&H Jubilación

Annual Return

| BH JUBILACIóN | |

|---|---|

| 2025 | -2,70% |

| 2024 | 8,40% |

| 2023 | 20,29% |

| 2022 | -17,85% |

| 2021 | 25,63% |

| 2020 | -1,15% |

| 2019 | 22,66% |

| 2018 | -16,40% |

| 2017 | -0,30% |

Returns net of fees.

Past performance is not indicative of future results.

Cumulative Return

| BH JUBILACIóN | |

|---|---|

| YTD | -2,70% |

| 1 Año | -1,40% |

| 3 Años | 11,97% |

| 5 Años | 68,01% |

| Inicio Oct 2017 | 32,42% |

Cumulative returns based on actual data.

Returns net of fees.

Past performance is not indicative of future results.

Every document always up to date

Other funds

you may also be interested in

Performance from BH Renta Fija Fija Europa Sicav, merged with B&H Bonds LU.

Performance of our most conservative fund.

Performance from Pigmanort Sicav, merged with B&H Flexible LU.

Performance from Rex Royal Blue Sicav, merged with B&H Equity LU.

Our pension plan to prepare your retirement.